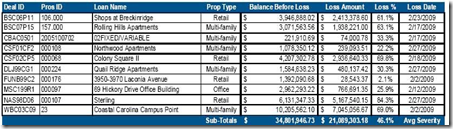

Via Zero Hedge, S&P reports lax loan underwriting is responsible for the upcoming losses on CMBS loans:

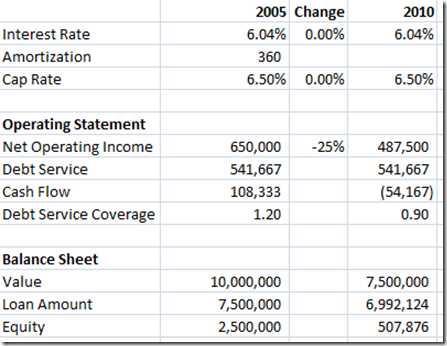

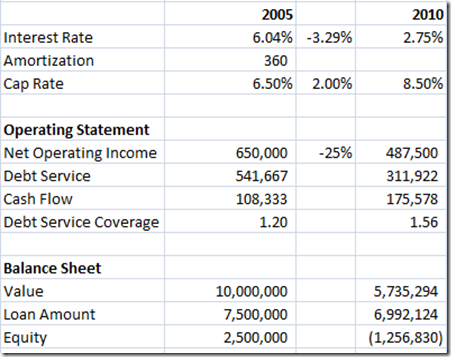

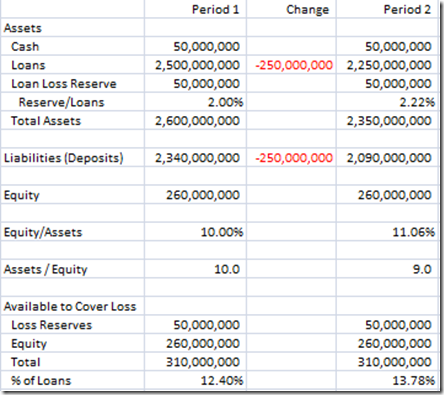

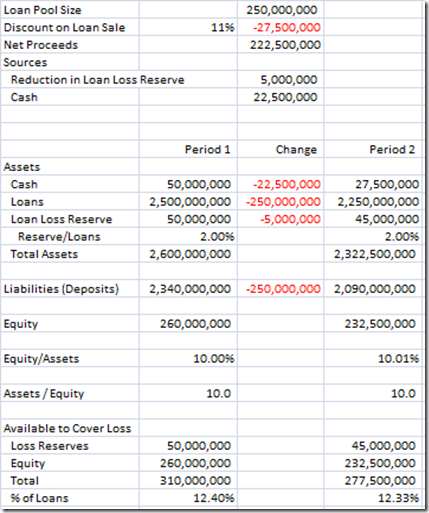

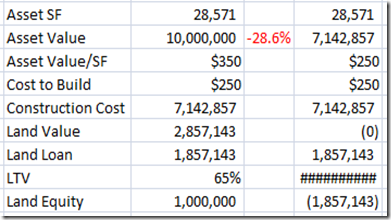

The rationale for the variation in results among the 2005-2007 vintages is that the underwriting standards, already looser than for past vintages, became progressively worse as the property cash flows and valuations rose quickly during those years. For example, most of the large pro-forma loans were underwritten during 2006 and especially 2007, and 2007 deals also claimed the highest average Standard & Poor's LTVs and lowest average Standard & Poor's DSCs (followed by 2006, then 2005). Thus, when commercial real estate prices and cash flows peaked in 2007, the most recent origination was by far the most vulnerable to cash flow declines…

This is the same explanation used to explain losses during the 1990-1994 real estate recession, the S&L debacle of the 1980’s, and probably every other major real estate downside since lending began. Why don’t we get any better at this?

An obvious explanation is that underwriters knew of the risks, but were ignored by management seeking profits and market share (I’ve posted on the pressures on credit officers here, and on the market share issue here). These are real issues, but I think there is a more fundamental problem; I think most underwriters, and many credit approvers, don’t know how to tell a good loan from a bad loan.

If you take the S&P approach outlined above, you don’t need to get into the details – at the top of the cycle, just tighten your LTV and DSC requirements. Of course, this advice is about as helpful as telling an investor to buy low and sell high. And, anyone who has been in a credit approval position knows how difficult it is to pull back in a strong market. Given that you are going to have to do business during market peaks, how can you select the deals most likely to succeed?

The way people become experts is through thoughtful practice. In his book, How We Decide, Jonah Lehrer profiles Herb Stein, a television director who has shot more than 50,000 scenes and won eight Emmies over a twenty five year career. After shooting an episode, Stein says:

I watch the whole thing, and I just take notes. I’m looking really hard for my mistakes. I pretty much always want to find thirty mistakes, thirty things that I could have done better. If I can’t find thirty, then I’m not looking hard enough.

Bill Robertie, a world class chess master and poker and backgammon player (backgammon World Champion twice), is also profiled:

Robertie didn’t become a world champion just by playing a lot of backgammon. “It’s not the quantity of practice, it’s the quality,” he says. According to Rpbertie, the most effective way to get better is to focus on your mistakes… After Robertie plays a chess match, or a poker hand, or a backgammon game, he painstakingly reviews what happened. Every decision is critiqued and analyzed. Should he have sent out his queen sooner? Tried to bluff with a pair of sevens? What if he had consolidated his backgammon blots? Even when Robertie wins – and he almost always wins – he insists on searching for his errors, dissecting those decisions that could have been a little better. He knows that self-criticism is the key to self-improvement; negative feedback is the best kind.

Underwriters don’t have the opportunity to do this kind of analysis, for three reasons. The first is that lenders do very little meaningful analysis of existing loan performance. Asset management monitors debt service coverage, occupancy, property condition, and that’s about it, which is like trying to diagnose an illness from the patient’s weight, blood pressure, and temperature. These performance metrics are monitored because they’re easy, but they’re just not that revealing. I don’t know of any lenders who systematically analyze underperforming deals to understand why they are underperforming (see my posts, “Why What You Know About Income Property Performance is Probably Wrong”, and “The Slippery Slope to Default” for more on what lenders should be paying attention to).

The second problem is that there is rarely a feedback loop to the underwriters giving them even the minimal performance data collected. The back-end asset management group and front-end underwriting are not connected, and the lessons to be learned at the back from actual performance are rarely conveyed to the front in a useful form.

These two problems are correctable, but the third problem is more difficult. Stein has daily rough cuts to review for mistakes. Robertie has many games each day he can review and analyze. But, CRE underwriting mistakes are generally only revealed when markets are under economic stress, and such events may happen only four or five times in an underwriter’s entire career. The consequences are twofold. First, bad deals are never revealed because they never are stressed by a downturn -almost every CRE loan made from 1995 to 2007 has performed to date, because it was never stressed. Secondly, good deals are overwhelmed by economic events – there were good loans made in 2006-07, but it is very likely many of those loans will default given the severe distress of this market. Stein and Robertie have an opportunity to excel because they have frequent, clear feedback. Even under the best of circumstances, CRE underwriters get infrequent, unclear feedback. I’ve written more on feedback issues in my post “Why Do Lenders Take Excessive Risks? Certainty and Feedback Issues.”

To summarize, underwriting does not get better because the opportunities to learn are infrequent, little effort is made by lenders to learn even when the opportunity presents itself, analysis is confined to superficial symptoms, and the little that is learned is not conveyed to the people who need the information. The only good thing I can say is there is plenty of opportunity for improvement.