We all know there are large variations in how much housing markets have appreciated and depreciated. Here is a chart from The Mess that Greenspan Made which is a little dated but which gives you the idea of the upward trajectories:

(click for a larger image in a new window)

Here is a chart from Calculated Risk showing the latest peak to date drops for the cities in the Case Schiller Index:

(Click to open larger version in a new window). This post in The Big Picture has the change data.

Why is there such a large variation? Most of the explanations I have heard our vague references to speculators, fraud, imprudent borrowers, etc. somehow being correlated to the geography. Maybe, but I find it hard to believe these explanations can account for the differences between cities like San Francisco and Dallas. I think what is going on relates much more to do with demand, supply, and the demographics and characteristics of the housing stock of these cities than the character of the residents. Here is my theory:

The Bubble was Inflated by Easier Credit. I’m not going to spend any time documenting this premise, I think it’s fairly well accepted.

For a Bubble to Happen, You Need Demand (Incremental New Buyers). Easier credit opened the market to more low income buyers, who could now qualify for loans because income and credit standards were relaxed. If this is true, you would expect the bubble cities to have lower median incomes than non-bubble cities.

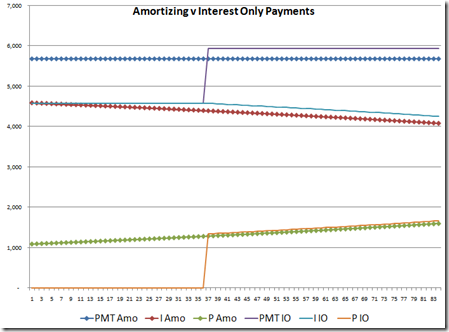

For a Bubble to Happen, You Need Supply (Incremental New Sellers). The focus has been on new construction, but new construction is only a small fraction of the existing stock. Existing home owners obviously buy and sell, but when an existing owner sells and buys there’s no change in demand or supply. The most likely new sellers of housing to newly qualified buyers are the owners of rental houses, and existing renters of homes are obviously candidates to buy. If this is true, you would expect bubble cities to have relatively high percentages of single family rental housing.

Are these hypotheses true? Here is a table rank ordering the Case Shiller cities (worst to best) which also shows their rank by median household income and percent of renter occupied 1 unit attached and detached housing of the total occupied housing stock. The median income and rental housing data are a custom report from the Census 2000 Summary File 4 which can be downloaded here. The larger the CS Rank number, the bigger the drop in house prices from the peak (e.g., Phoenix is the worst performer). For median income rank, the higher the number the lower the median income (e.g., Tampa has the lowest median income of the 20 markets). For renter occupied 1 unit structures, the higher the number the more such structures (e.g., Los Angeles has the most house renters).

(Click on table to enlarge in a new window)

The hypotheses account for the worst six markets. #7, Detroit, is in it’s own private employment hell so I think it’s an outlier. Of the markets that are performing relatively well, we have Cleveland (relatively low income but also a low percentage of rental homes), and Portland and Charlotte (relatively high supply of rental homes but also relatively high income). Of the two factors, I think low median income is the more important. Most people do not think of Miami, Las Vegas, and Los Angeles as relatively poor cities (the influence of television, I believe), but they are.

On the whole, I think the data are consistent with the theory.